Planning is the process of creating a comprehensive financial plan that outlines an organization’s...

The Four Tenets of OneStream Machine Learning

Welcome back to the second installment in our series on machine learning for financial forecasting.

In our first blog, "Unleashing the Power of Machine Learning", we discussed the history of machine learning and the importance of time series regression analysis on how the world of economics also takes advantage of this. Today, we'll dive deeper into why this technique is so crucial for economic forecasting and why it's relevant to OneStream’s SensibleAI Forecast Solution.

In the field of economics, many variables are measured over time, such as GDP, inflation rates, and unemployment rates. By analyzing these variables over time using time series regression analysis, economists can identify patterns and relationships between them. For example, they might discover that when GDP growth is high, inflation rates tend to be high as well.

These insights are essential for forecasting future economic trends and making informed financial decisions. For instance, a government might use time series regression analysis to forecast tax revenues, which can help them determine how much to allocate to various programs and services. Similarly, a business might use time series regression analysis to forecast sales, which can help them make decisions about inventory and production levels.

In short, time series regression analysis is a critical tool for anyone looking to make data-driven financial decisions. Whether you're a government, a business, or an individual investor, the insights gained from this technique can help you stay ahead of the curve and make informed choices.

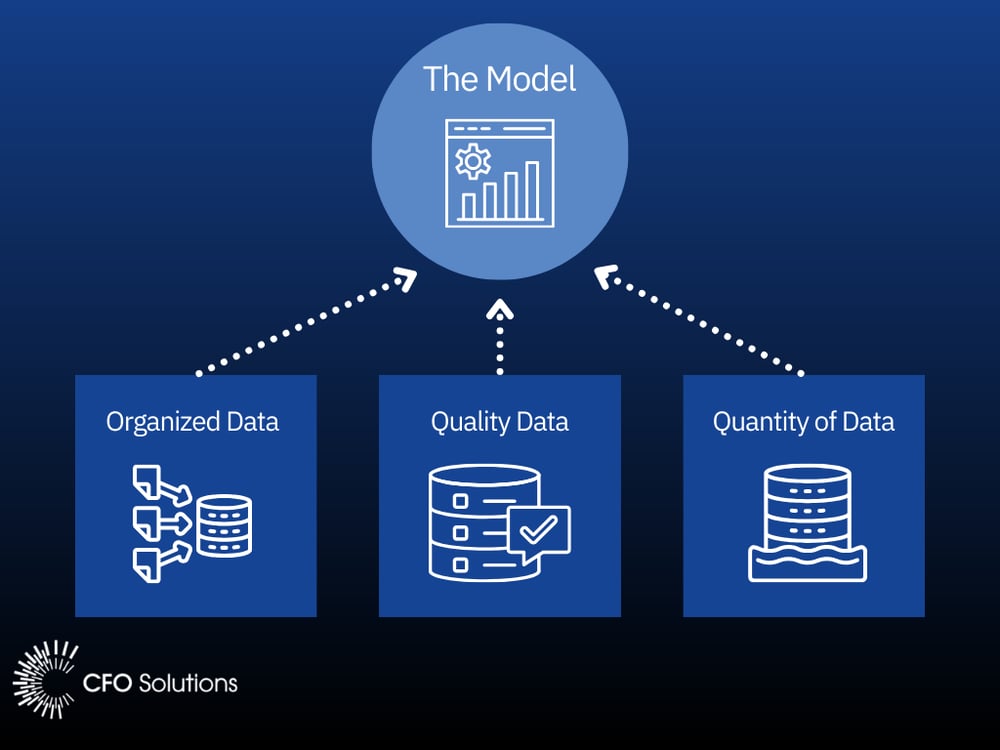

As time series regression analysis is both important to economics and the engine behind the SensibleAI Forecast Solution. I want to take you back to my final year of university, studying time series regression analysis, and what the four main tenets of a successful forecast is:

Quality of Data

The accuracy of predictions in time series regression forecasting heavily depends on the quality of data. Poor-quality data can result in inaccurate forecasts, leading to poor decision-making. Several factors can affect data quality, including errors, missing data, outliers, and inconsistencies. Therefore, ensuring that the data used for time series regression forecasting is accurate, complete, and consistent is essential.

Amount of Data

The amount of data used in time series regression forecasting is also critical. A small amount of data may not provide enough information to identify patterns and trends, while too much data can lead to overfitting, where the model fits the noise in the data rather than the underlying patterns. Therefore, it is essential to find the right balance between the amount of data used and the complexity of the model.

Organized Data

Organizing data is another critical factor in time series regression forecasting. Data must be organized in a way that enables easy analysis and interpretation. This includes sorting data chronologically, identifying and handling missing values and outliers, and selecting appropriate time intervals for analysis. Failure to organize data can lead to inaccurate predictions and poor decision-making.

Regression Model Used

The regression model used in time series regression forecasting plays a significant role in the accuracy of the predictions. There are various types of regression models, including linear regression, logistic regression, and polynomial regression. The choice of the regression model depends on the data's nature and the forecast's objective.

Additionally, it is essential to evaluate the performance of the model and adjust it as needed. I ended the last post with a bit of ambiguity as to why OneStream was always one step away from Machine learning.

Pay close attention to the diagram above, and more specifically the bottom layer. Doesn’t it remind you of something? Well, OneStream’s solution at its core is the ability to manage, organise and obtain data to its cleanest of forms, which has allowed it to become a market leader within the EPM space. So, from the brief lesson in time series regression above, would you agree it sounds very similar to the value of OneStream? Well, if not:

Organized Data:

OneStream provides a centralized platform for all financial and operational data, enabling organizations to integrate and consolidate data from disparate sources. The platform's unified data model ensures that data is standardized and eliminates data silos and inconsistencies. OneStream's dimensionality allows for granular data modeling and analysis, resulting in accurate and timely financial reporting.

Quality Data:

OneStream's built-in data validation and verification tools help ensure that data is accurate and complete. The platform's data integrity checks, audit trails, and version control features also help improve the quality of data. OneStream's unified platform enables organizations to eliminate manual data entry and reconciliation, reducing the risk of errors.

Quantity of Data:

OneStream's scalability enables organizations to handle large amounts of data. The platform's ability to integrate data from various sources, as well as its support for multiple currencies and languages, enables organizations to manage data across different geographies and business units. OneStream's ability to handle complex financial models and scenarios, including driver-based planning, rolling forecasts, and scenario analysis, enables organizations to handle large volumes of data with ease.

The final tenet in the OneStream Machine Learning Bingo

The Model:

OneStream's SensibleAI Forecast solution uses a process called model selection to choose the best regression model for a given dataset. The SensibleAI Forecast solution then compares the performance of each model and selects the one that provides the best balance between accuracy and simplicity. This approach ensures that the selected model is not too complex, which can lead to overfitting, nor too simple, which can lead to underfitting.

Overall, by using multiple regression models and selecting the best one for a given dataset, OneStream's SensibleAI Forecast solution can provide accurate and reliable forecasts for financial planning and analysis.

Time series regression analysis is a critical tool for making data-driven financial decisions, and the success of its predictions relies heavily on the quality, amount, organization, and regression model of the data used. OneStream's platform excels in these areas, providing a centralized and standardized data model, built-in data validation tools, and scalability to handle complex financial models and scenarios. With the introduction of OneStream's SensibleAI Forecast solution, utilizing time series regression models to select the most appropriate model for the data, they have established the four tenet for an accurate forecasting model. It's clear that OneStream's continued innovation in the field of machine learning has always been a forward step.

-4.jpg?height=200&name=Blog%20Images%20-%20484%20x%20200%20px(1)-4.jpg)