An effective close process is crucial for ensuring accuracy, compliance, and timely reporting. The...

Implementing Rolling Forecasts: Navigating Financial Agility

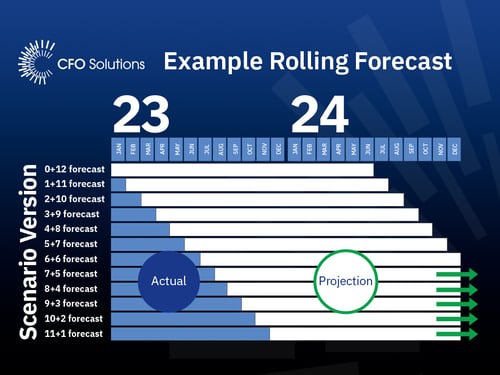

In a time where economic landscapes are continuously evolving, organizations are compelled to adopt financial planning approaches that are both adaptive and forward-looking. rolling forecasts emerge as a pivotal tool in this context, offering a dynamic, continuous financial planning method that transcends the conventional annual budgeting framework.

Let’s look at ways to reinforce the best practices in rolling forecasts, the essential changes in management reporting, and the recalibration of organizational metrics to effectively harness this approach.

Unveiling the Essence of Rolling Forecasts

Rolling forecasts are not merely a financial tool; they embody a strategic planning methodology that perpetually extends the forecast horizon, typically spanning six to eight quarters, thereby ensuring that organizations are constantly planning for a consistent future period. This approach facilitates a more nimble and responsive financial planning process, enabling organizations to adeptly navigate through the ebbs and flows of the business environment.

Best Practices: Crafting a Robust Rolling Forecast

- Defining Objectives with Precision: Establishing clear, strategic objectives for the rolling forecast allows it to serve as a compass, guiding organizational efforts and resources toward pivotal goals. This involves aligning forecasts with overarching strategic imperatives by catering to both short-term operational and long-term strategic needs.

- Involving Cross-Functional Insights: Engaging diverse departmental perspectives in the forecasting process not only enriches the data but also creates a holistic and inclusive financial plan that considers varied organizational facets.

- Technological Leverage: Employing advanced forecasting technologies and software automates data collection and analysis, thereby mitigating manual errors and enhancing efficiency. This involves selecting platforms that facilitate seamless data integration, predictive analytics, and intuitive user interfaces.

- Focusing on Key Business Drivers: Identifying and concentrating on pivotal business drivers, such as customer demand, market trends, and operational efficiency, establishing that the forecast remains focused and actionable.

Integrating Management Reporting and Metrics: A Symbiotic Alignment

Transitioning to a rolling forecast necessitates a recalibration of management reporting and organizational metrics to ensure they are congruent with the dynamic and continuous nature of this approach.

- Adaptation of Reporting Frequency: Transitioning to more frequent reporting cycles, such as monthly or quarterly, safeguards that decision-makers are equipped with timely and relevant data, thereby enabling them to respond adeptly to emerging opportunities and challenges.

- Refinement of KPIs: KPIs must be meticulously refined so that they are not only aligned with organizational strategy but also sensitive to the dynamic inputs and outputs of the rolling forecast. This involves ensuring that KPIs are both relevant and actionable, providing clear insights into performance, and driving informed decision-making.

- Development of Future-Oriented Metrics: Crafting metrics that provide insights into future performance, such as forward revenue projections and future cash flow estimates, confirms that the organization is not merely responding to historical data but is proactively navigating toward future financial horizons.

- Enhancement of Data Visualization: Leveraging advanced data visualization tools ensures that complex data and trends are communicated effectively, thereby enabling stakeholders to comprehend and act upon the insights gleaned from the rolling forecast.

- Scenario Analysis Integration: Embedding scenario analysis into management reporting provides a robust framework for understanding the potential implications of various factors and uncertainties, thereby enabling the organization to strategize and plan across multiple potential future trajectories.

A Future-Forward Financial Paradigm

Rolling forecasts, when meticulously implemented and integrated with recalibrated management reporting and metrics, pave the way for a future-forward financial planning paradigm. This approach not only enhances financial agility but also makes certain that organizations are equipped with the insights and foresight required to navigate through the multifaceted business environment.

In essence, rolling forecasts emerge not only as a financial tool but as a strategic asset, propelling organizations toward sustained, informed, and agile financial success.

Looking for ways for your organization to be more flexible and agile when it comes to your rolling forecast? CFO Solutions can help!

.png?width=500&height=375&name=traditional_budgetin_v_rolling_forecasts_blog_graphic%20(2).png)

-Dec-18-2024-10-43-14-0478-AM.jpg?height=200&name=Blog%20Images%20-%20484%20x%20200%20px(1)-Dec-18-2024-10-43-14-0478-AM.jpg)

-2.jpg?height=200&name=Blog%20Images%20-%20484%20x%20200%20px(1)-2.jpg)